The Financial Commission, a leading independent, non-governmental self-regulatory organization and external dispute resolution (EDR) forum announces its latest operational metrics for the second quarter of 2025. The organization experienced a significant rebound in many key metrics following a previous seasonal slowdown, including a rise in amounts sought, awarded, average complaint values, and others. The forum continued to provide a quick and efficient service, with complaints being resolved on average in just 7.8 days.

As part of its founding core principles to protect traders from possible scams, Ponzi schemes, and fraudulent activities online, The Financial Commission placed over 15 new websites on its Warning List.

Furthermore, the forum added several broker members during the quarter to bolster its membership ranks.

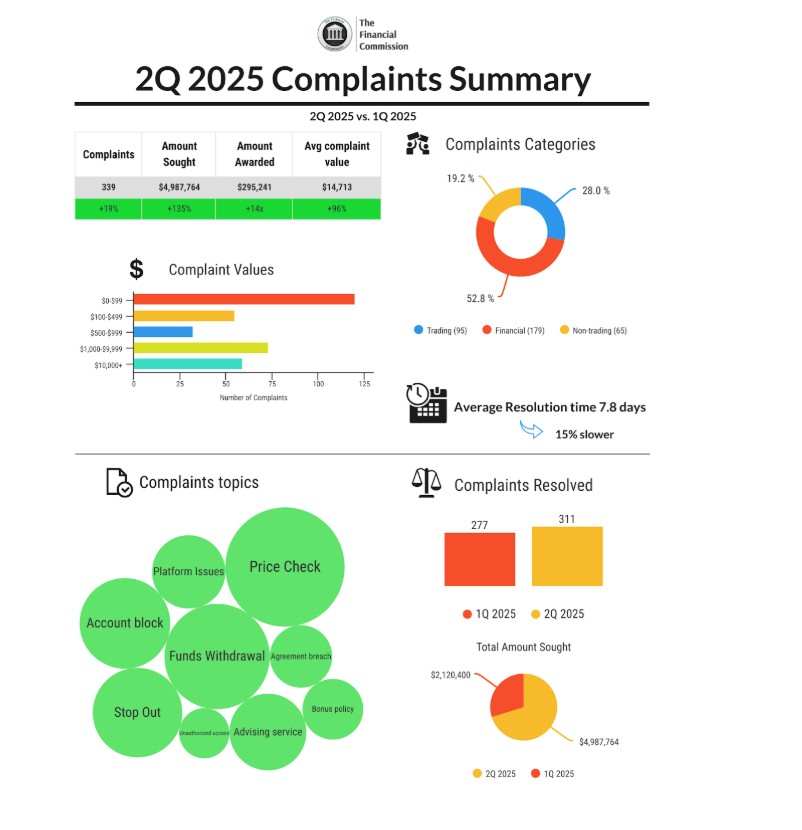

Key highlights for 2Q 2025 vs. 1Q 2025:

- New filed complaints increased by 19%

- Total resolved complaints up 13%

- Compensation sought from all brokers doubled to $4.987M

- Total amount awarded to traders up 13x to $295,241

- Average complaint values doubled to $14,713

- Average resolution times slowed by 15% to 7.8 days

Quarterly Comparison

Key Takeaways

- Significant rebound in new filed complaints following seasonal slowdown

- Increased demand for compensation from traders of broker member firms

- Rise in the share of trading related and HNW complaints

- Complaints resolution times slowed, yet continued to be quick

Conclusions

With the passing of a traditional seasonal slowdown and renewed investor focus on safe-haven assets and commodities, such as gold and oil, the Financial Commission experienced a rise in demand for external dispute resolution (EDR), while continued efforts to warn the public of potential scams and alleged fake broker services attributed to the decrease in complaints filed against non-member firms. Specifically, the organization experienced a 19% boost in new complaints filed, while the total number of complaints resolved in the quarter improved by 13%. At the same time, total complaints amounts sought and average complaint values all rose by 135% and 96% respectively. While the amount of cases ruled in favor of traders remained steady QoQ, the total amount awarded to traders during the quarter was almost 13x higher than in 1Q 2025, attributed to several large, HNW complaints.. In complaint categories, financial-related complaints continued to dominate for 2Q 2025, yet the share of trading related complaints rose 3% QoQ, highlighting the increased submission of cases related directly to execution quality and pricing. Complaint values for the quarter indicated that the Financial Commission continues to receive a significant amount of complaints in the HNW (high net-worth category; $1K-10K+) category, with a 39% share of all complaints filed in the quarter.

During the period, the Dispute Resolution Committee (DRC) resolved complaints slower than in the previous quarter, with 7.8 days in average dispute resolution time.

About Financial Commission

The Financial Commission is an independent external dispute resolution (EDR) organization for consumers/traders who are unable to resolve disputes directly with their financial services providers who are members of the Financial Commission. The Financial Commission initially set out to provide a new approach for traders and brokers alike to resolve any issues that arise in the course of trading electronic markets such as Foreign Exchange, and then expanded into CFDs and related derivatives, in addition to certifying technology platforms used for trading.

For more information please contact us at .